| Bookmaker | Free Bet Offer | Claim Offer | T&C’s |

|---|

| bet365 | Bet £10 Get £30 in Free Bets | Visit Site | Full T&Cs Apply! For new customers at bet365. Min deposit requirement. Free Bets are paid as Bet Credits and are available for use upon settlement of bets to value of qualifying deposit. Min odds, bet and payment method exclusions apply. Returns exclude Bet Credits stake. Time limits and T&Cs apply. Registration required. 18+ Begambleaware.org |

How to Use the Betting Calculator

The betting odds calculator is a very simple tool. It requires very little knowledge. Below we have created a set of boxes that are the three basic steps to attaining a return and profit calculation.

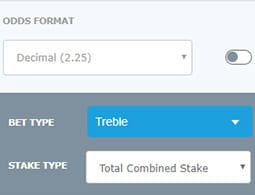

- Select the Options

Before starting anything it essential all your preferred options are selected. The odds format (decimal, fractional), stake type, and if there are any extra rules, such as each-way. You then need to enter the stake amount.

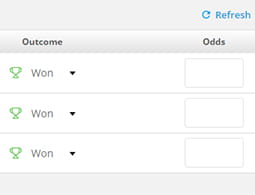

Before starting anything it essential all your preferred options are selected. The odds format (decimal, fractional), stake type, and if there are any extra rules, such as each-way. You then need to enter the stake amount. - Insert Odds

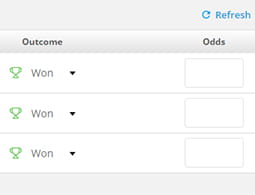

Then, depending on the number of selections your bet has, you need to enter their corresponding odds into the empty boxes. Don’t forget to enter them in the format you chose in the previous step.

Then, depending on the number of selections your bet has, you need to enter their corresponding odds into the empty boxes. Don’t forget to enter them in the format you chose in the previous step. - Calculate the Return and Profit

This is the easiest step in the process, as you actually don’t need to do anything! If you have done the previous steps correctly then these should automatically appear!

This is the easiest step in the process, as you actually don’t need to do anything! If you have done the previous steps correctly then these should automatically appear!

Bet Options Explained

In the boxes below we will now go into detail about the terms used in our betting profit calculator.

Odds Format

The odds format is simply choosing the way in which the odds are displayed. This can be fractional (3/1), decimal (4.0), or American (+300). In the UK, fractional has traditionally been used, however decimal, is beginning to gain traction.

The odds format is simply choosing the way in which the odds are displayed. This can be fractional (3/1), decimal (4.0), or American (+300). In the UK, fractional has traditionally been used, however decimal, is beginning to gain traction.

Selections

The selections option is the number of events you wish to bet on. For some bets, this will be a steadfast amount. Trixie’s, always need three selections, whereas accumulators can have as many as you want (until a maximum predefined by the bookie – usually 20).

The selections option is the number of events you wish to bet on. For some bets, this will be a steadfast amount. Trixie’s, always need three selections, whereas accumulators can have as many as you want (until a maximum predefined by the bookie – usually 20).

Stake

Here you have to choose if your stake will be a combined stake, or a per bet stake. If, for example you have a Trixie, and set £10 combined, that is your total outlay. However, if you select ‘per bet’,your total outlay will be £40, as there are four total bets on the ticket.

Here you have to choose if your stake will be a combined stake, or a per bet stake. If, for example you have a Trixie, and set £10 combined, that is your total outlay. However, if you select ‘per bet’,your total outlay will be £40, as there are four total bets on the ticket.

The Rules Explained

When looking at the betting calculator you may have noticed there were some different rules mentioned in the top corner. Here we will go into detail about what each of these means, and how they are relevant to our bet. Note that they relate particularly to wagers normally found on horse racing betting sites.

- EACH WAY RULES Each way is a two-part bet. You place one part on an outright winner, and the second part on placed finishes (2nd, 3rd, and 4th depending on the bookie). If the horse finishes first, you are paid both the ‘winner’ and the ‘place’ part. If it comes in 2nd to 4th you usually get paid 1/4 or 1/5th of the odds for your place stake. Note that you are liable for two stakes in this type of bet.

- RULE 4 RULES The rule 4 rules are reductions made to the winnings you receive when you have backed a horse to win or place in a race where one or more horse has withdrawn after already placing the bet. The odds offered at the starting price will no longer be valid, as a smaller field means it is now easier for your chosen horse to win. Therefore, your odds will be reduced to reflect this.

- DEAD HEAT RULES Dead heat rules are calculated when two or more horse cross the line in the exact same time. If there were 2 or more winners in a dead heat, the winnings are calculated by dividing the stake proportionally between the winners. So, in a two-way dead heat, your return will be half of what it would originally have been. A three-way, a third, and so on.

Bet Totals Explained

During our explanations on how the betting odds calculator works we have mentioned many different terms such as outlay (liability), return, and profit. What do they actually mean? See below.

Total Outlay

Your outlay, or liability is the total overall stake amount you will place on your bet. This is the amount that if your bet loses, you will not receive in return. Be aware that the bigger the system bet, the larger your outlay will be.

Your outlay, or liability is the total overall stake amount you will place on your bet. This is the amount that if your bet loses, you will not receive in return. Be aware that the bigger the system bet, the larger your outlay will be.

Total Return

Your total return is the amount you receive if your bet wins. This is figure always includes the stake you have bet, as this will be included in the winning figure. Hopefully you will receive a big return when you win!

Your total return is the amount you receive if your bet wins. This is figure always includes the stake you have bet, as this will be included in the winning figure. Hopefully you will receive a big return when you win!

Total Profit

The total profit is the overall amount of money you have made. This figure doesn’t include your original placed stake, instead just the overall additional sum you have made on the bet, or in other word the profit.

The total profit is the overall amount of money you have made. This figure doesn’t include your original placed stake, instead just the overall additional sum you have made on the bet, or in other word the profit.

The Advantages of the Calculator

The advantages of using our betting odds calculator are innumerable. Below, we have listed some of our favorites:

- Workout the totals of your bet automatically, you don’t have to press any extra buttons!

- Calculations happen in a quick and timely manner so you can see results instantly

- Adjust your odds to the changing market within an instant to easily compare prices

The Different Calculators for Every Type of Bet

With our dedicated calculator you can use it to work out numerous types of different bets. This ranges from the simple single, double, and treble, to the more complicated Lucky 15, Canadian, and Goliath. In our list below, you can see the available tools, and you can go directly to their dedicated pages.

The odds format is simply choosing the way in which the odds are displayed. This can be fractional (3/1), decimal (4.0), or American (+300). In the UK, fractional has traditionally been used, however decimal, is beginning to gain traction.

The odds format is simply choosing the way in which the odds are displayed. This can be fractional (3/1), decimal (4.0), or American (+300). In the UK, fractional has traditionally been used, however decimal, is beginning to gain traction. The selections option is the number of events you wish to bet on. For some bets, this will be a steadfast amount. Trixie’s, always need three selections, whereas accumulators can have as many as you want (until a maximum predefined by the bookie – usually 20).

The selections option is the number of events you wish to bet on. For some bets, this will be a steadfast amount. Trixie’s, always need three selections, whereas accumulators can have as many as you want (until a maximum predefined by the bookie – usually 20). Here you have to choose if your stake will be a combined stake, or a per bet stake. If, for example you have a Trixie, and set £10 combined, that is your total outlay. However, if you select ‘per bet’,your total outlay will be £40, as there are four total bets on the ticket.

Here you have to choose if your stake will be a combined stake, or a per bet stake. If, for example you have a Trixie, and set £10 combined, that is your total outlay. However, if you select ‘per bet’,your total outlay will be £40, as there are four total bets on the ticket. Your outlay, or liability is the total overall stake amount you will place on your bet. This is the amount that if your bet loses, you will not receive in return. Be aware that the bigger

Your outlay, or liability is the total overall stake amount you will place on your bet. This is the amount that if your bet loses, you will not receive in return. Be aware that the bigger  Your total return is the amount you receive if your bet wins. This is figure always includes the stake you have bet, as this will be included in the winning figure. Hopefully you will receive a big return when you win!

Your total return is the amount you receive if your bet wins. This is figure always includes the stake you have bet, as this will be included in the winning figure. Hopefully you will receive a big return when you win! The total profit is the overall amount of money you have made. This figure doesn’t include your original placed stake, instead just the overall additional sum you have made on the bet, or in other word the profit.

The total profit is the overall amount of money you have made. This figure doesn’t include your original placed stake, instead just the overall additional sum you have made on the bet, or in other word the profit.